Our Mission and the Values we live by

Mission

We will delight our customers and greatly enhance there wealth creation efforts with superior financial advice, and innovative, and most appropriate solutions for each customer. We will strive to be amongst the top ten retail financial services firms and offer the most diversified portfolio of investment products and services.

Values

Teamwork

At GEPL Capital, Teamwork is vital for our success. We work as a team and believe that we are a sum of our collective talent. We collaborate with each other to provide new and innovative solutions to our clients.

Client Servicing

We will always put the interests of our clients first. When they grow, we grow. Our wealth management and financial services advisors and customer service specialists will continue to exceed customer expectations.

Integrity

Our business has been built on Trust and Integrity. We strive to do everything right for our clients and our company. Our clients are always fully aware about the status of there investments with us.

1997

Established In

150+

Locations

22

Branches

200+

Partners

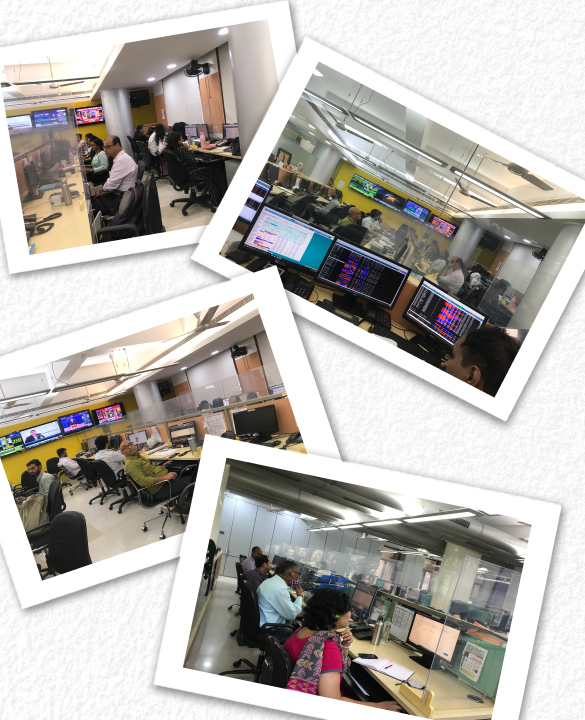

Company Overview

Our single-minded focus on our customers has helped us grow with them over these last two decades. We value our employees and associates who fully understand our customers’ needs. develop personalized strategies and make finance management easy for them. Our values make us one of the most trust-worthy advisors in the financial services space.

We believe in long term relationships with our clients, both Retail and Institutional. This means that we simplify everything for them, be it technology, investment technicalities, or pricing.

We have a technology driven approach with easy-to-use desktop and mobile apps to make investing super easy for our clients.

Our top-class research and analysis teams deliver daily, weekly, and monthly reports on Technical and Fundamental research of the financial markets as well as for Mutual Funds.

We cater across the gamut of Financial Services from Mutual Funds and Equity to IPOs, Wealth Management, Advisory Services, Insurance, Bonds, NCD, Corporate Fixed deposits, Loan against Shares & Demat services.

Our bouquet of products and services for the Non-Resident Indians as well as Resident Indians, have ensured maximum returns for them, in both debt and equity markets.