Request a call back

We will reach you in next 24 hours.

In-depth research reports & recommendations by experienced Market Research Professionals

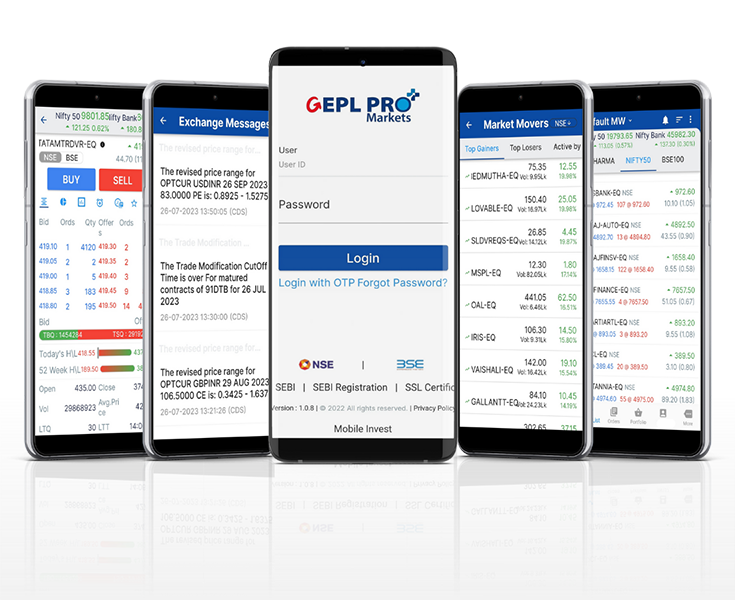

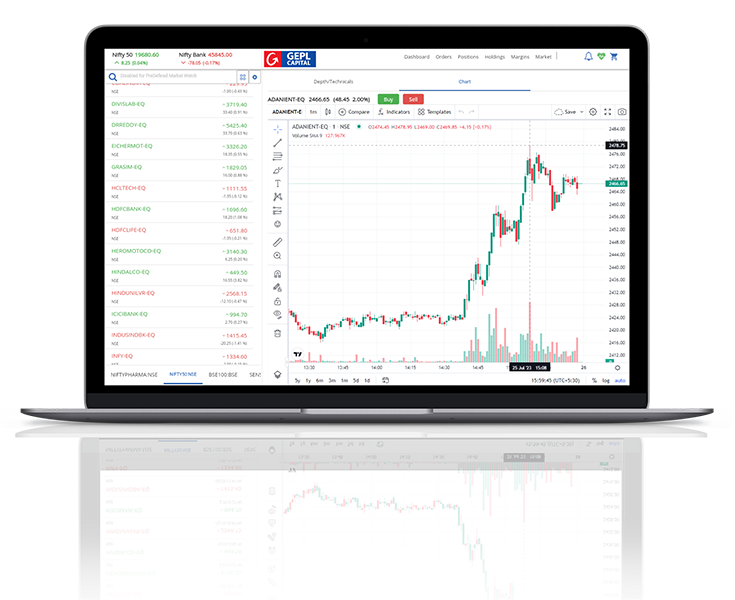

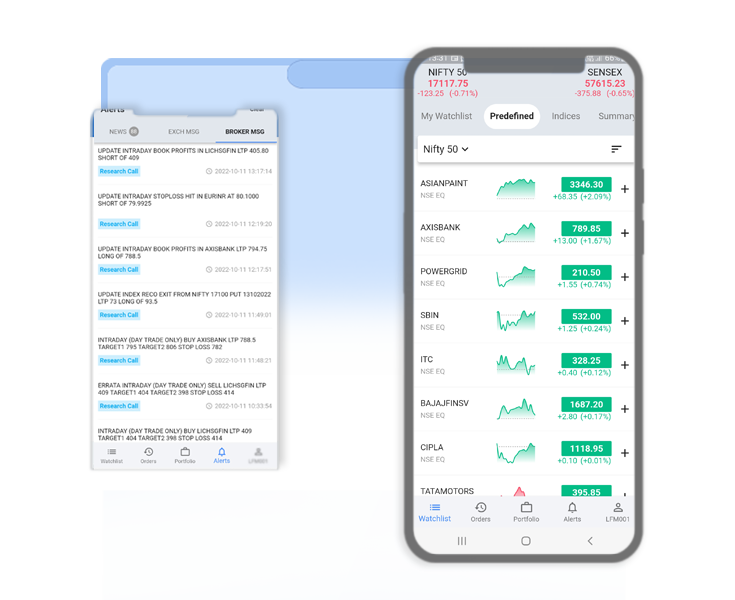

Free user friendly advanced trading softwares.

Lien-based Fund system to avoid extra funds blockage.

Online and offline support gives customers an edge

Clients can attend virtual and physical training sessions and use an online knowledge center

Bank of India and GEPL Capital Pvt Ltd. offer GEPL-BOI Online Trading, a 3-in-1 product. This product lets Bank of India customers access the Indian equities market easily. Below are the product integrations:

All three accounts are integrated to offer BOI customers a hassle-free trading experience. Clients can invest anytime, anywhere by marking real-time lien for funds or securities from their registered Bank of India Savings or Demat account using GEPL Trading Portal or Mobile App.. Bank of India customers can trade on both NSE and BSE.

Bank of India Savings & Demat Account holders can open GEPL Capital trading account & avail the benefits of investing in Indian Equities Market. The integration consists of:

The real-time integration of BOI Savings-Demat account with GEPL Capital Trading account provides a hassle-free and seamless trading experience without having to worry about Fund or Securities Transfer.

Funds that have been blocked (marked as a lien) for trading are unblocked on the same trading day, allowing BOI account holders to use the funds for other purposes and preventing any additional blockage of funds. Securities that have been blocked (marked as a lien) for sale are verified in real time, preventing any disproportionate sale of shares.

GEPL-BOI account holders can apply for IPOs through GEPL Capital Website or the Self Care portal by simply entering their client code and PAN number.

GEPL-BOI account holders can request for an online modification by entering their client code and PAN number on the GEPL Capital website or the Self Care portal

GEPL-BOI customers can use the free call and trade facility at any of the GEPL Capital offices .

GEPL-BOI customers have broad access to GEPL Capital research reports, research calls, and IPO recommendations, which include in-depth macro and micro research data as well as sound and customised advisory support to help them make informed investment decisions.

GEPL Capital has a dedicated Customer Care desk for BOI customers, with efficient problem-solving experts and a team for quick resolution of online trading queries.