Request a call back

We will reach you in next 24 hours.

Settlement in Running account

Podcast

Quarterly Settlement or Settlement of Funds and Securities

SLBM (Stock Lending And Borrowing Mechanism)

Change in Clearing Corporation under Interoperability from BSE to NSE

Settlement in Running account

When does a client account need to be settled?

As per SEBI circular MIRSD/ SE /Cir-19/2009 dated December 3, 2009 and

SEBI/HO/MRD/DP/CIR/P/2016/135 dated December 16, 2016, the settlement of funds

and / or securities shall be done within 1 working day of the pay-out, unless client

specifically authorizes the trading member in writing to maintain a running account.

Vide SEBI circular no. CIR/HO/MIRSD/DOP/CIR/P/2019/75 dated June 20, 2019, running

account for securities has been discontinued and therefore, SEBI circulars dated

December 03, 2009 and September 26, 2016, are now applicable for settlement of

running account of client’s “funds” only.

Vide SEBI circular no. SEBI/HO/MIRSD/DOP/P/CIR/2022/101 dated July 27, 2022, the

settlement of running account of funds of the client shall be done by the trading

member after considering the End of the day (EOD) obligation of funds as on the date

of settlement across all the Exchanges on first Friday of the Quarter (i.e., Apr-Jun, JulSep, Oct-Dec, Jan–Mar) for all the clients i.e. the running account of funds shall be

settled on first Friday of October 2022, January 2023, April 2023, July 2023 and so on. If

first Friday is a trading holiday, then such settlement shall happen on the previous

trading day.

For clients, who have opted for Monthly settlement, running account shall be settled

on first Friday of each month. If first Friday is a trading holiday, then such settlement

shall happen on the previous trading day.

What should be the periodicity for settlement of client funds?

In case a client wishes to maintain a running account for its funds with the trading

member, the client has to authorize the member in writing to retain its funds. Such

authorization should also contain:

▪ Mandate of the client as to whether the settlement of funds should be done on

monthly / quarterly basis.

▪ A clause stating thatthe Clientmay revoke the authorization at any time (i.e.without notice)

Running account authorisation received through online secured access by way of client

specific user id & password or through a registered email id of client is considered as

authorisation in writing.

As per SEBI circular no. SEBI/HO/MIRSD/DOP/P/CIR/2022/101 dated July 27, 2022, the

settlement of running account of funds of the client shall be done by the trading

member on first Friday of the Quarter (i.e., Apr-Jun, Jul-Sep, Oct-Dec, Jan–Mar) for all

the clients who have opted for quarterly settlement i.e., the running account of funds

shall be settled on first Friday of October 2022, January 2023, April 2023, July 2023 and

so on. If first Friday is a trading holiday, then such settlement shall happen on the

previous trading day.

For clients, who have opted for Monthly settlement, running account shall be settled

on first Friday of each month. If first Friday is a trading holiday, then such settlement

shall happen on the previous trading day.

As per SEBI circular no. SEBI/HO/MIRSD/DOP/P/CIR/2022/101 dated July 27, 2022, the

actual settlement of funds shall be done by the member on first Friday of the Month or

Quarter as per the preference of the client.

Further, as per SEBI Circular SEBI/HO/MIRSD/DOP/P/CIR/2021/577 dated June 16,

2021, for the clients having credit balance, who have not done any transaction in the 30

calendar days since the last transaction, the credit balance shall be returned to the

client by trading member, within next three working days irrespective of the date when

the running account was previously settled. Further, after settlement, if such client

returns to the member with fresh funds and no trades are executed during this period,

then members may compute the 30 calendar days for the purpose of subsequent

settlement from the day the member receives funds instead of the last transaction date.

However, member shall settle running account of client on first Friday of the quarter or

month as per as per the preference of the client irrespective of date of his/her last

transaction or receipt of funds.

Illustration (For client accounts having credit balance and not traded in last 30 calendar

days)

Settlement preference given by client (A) | Last settlement date (B) | Last trade date (C) | Date on which settlement due if client not traded in 30 days from the last trade mentioned in column C (D) | Date of fresh receipt of funds post settlement done on the date mentioned in column D (E) | Next settlement due date (F) |

| Quarterly | 07-Oct-2022 | 10-Oct-2022 | 09-Nov-2022 | 30-Nov-2022 | 30-Dec-2022 |

| Quarterly | 06-Jan-2023 | 08-Feb-2023 | 10-Mar-2023 | 24-Mar-2023 | 07-Apr-2023* |

*first Friday of the Quarter

If the client has not done any Exchange transaction in the last 30 calendar days but

has an open position in derivatives segment, still the credit balance should be

returned to client within next three working days?

If the client has an open position in the derivatives segment, then the date of contract

expiry or the date on which position is closed may be treated as last transaction date,

for the purpose of computing 30 calendar days for returning the credit balance to such

clients. However, members shall ensure settlement of running account of funds on first

Friday of the Month or Quarter as per the preference of the client.

Illustration (For client accounts having credit balance and open position in derivatives

segment)

Settlement preference given by client | Last settlement date | Last settlement date | Position closure date | Contract Expiry date | Next settlement due date |

| Quarterly | 07-Oct-2022 | 10-Oct-2022 | 18-Oct-2022 | NA | 17-Nov-2022 |

| Quarterly | 07-Oct-2022 | 10-Oct-2022 | NA | 27-Oct-2022 | 26-Nov-2022 |

| Monthly | 07-Oct-2022 | 10-Oct-2022 | 18-Oct-2022 | NA | 04-Nov-2022* |

| Monthly | 07-Oct-2022 | 10-Oct-2022 | NA | 27-Oct-2022 | 04-Nov-2022* |

What if the client has not done any Exchange transaction in the last 30 calendar days,

but executes transaction within next three working days?

If the client executes a transaction on the Exchange on or before the date on which

member is scheduled (within three working days) to return the credit balance, in that

case, the member may retain the funds as clarified in Point 5 and settle the balance

amount to client.

What is the value of funds that a trading member can retain while doing the

settlement?

In case of client having any outstanding trade position on first Friday of the Month /

Quarter on which settlement of running account of funds is scheduled, a Trading

member may retain funds calculated in the manner specified below:

i. Entire pay-in obligation of funds outstanding at the end of day on date of

settlement, across all segments.

ii. Member may retain 50% of end of the day (EOD) margin requirement as cash

margin, excluding the margin on consolidated crystallized obligation/ MTM.

iii. Apart from 50% cash margin mentioned in point ii above, member may also

retain 225% of EOD margin (which includes additional 125% margin) reduced by

50% cash margin and the value of securities (after applying appropriate haircut)

accepted as collateral from the clients by way of ‘margin pledge’ created in the

Depository system for the purpose of margin and value of commodities (after

applying appropriate haircut). The margin liability shall include the end of the

day margin requirement in all the segments across exchanges excluding the

margin on consolidated crystallized obligation/ MTM. The margin liability may

also include the margin collected by the Member from their clients as per the

risk management policy and informed to the clients.

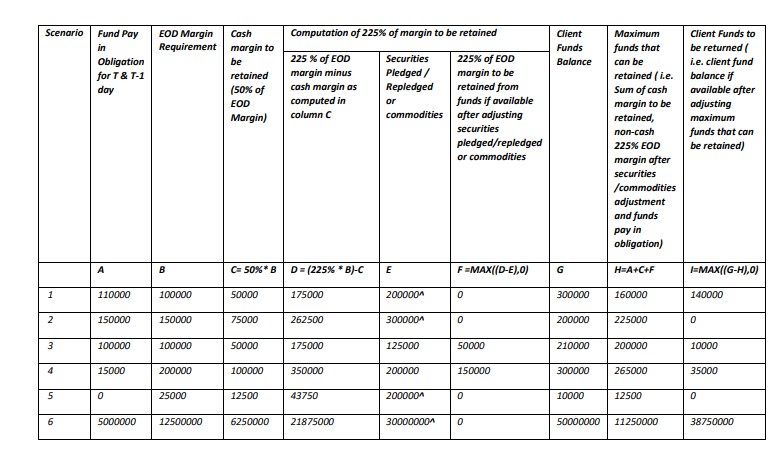

Computation for arriving at retention of excess client funds based on above points

would be as under:

^ Excess securities need not to be unpledged.

An indicative format of retention statement is attached as Annexure 1. In case of any other

format, members should ensure that the contents specified by the relevant circulars are

covered in the retention statement.

Note:

a) Client’s running account shall be considered settled if member has given

instructions to bank for credit to client’s bank account, provided that the member

has sufficient balance in its account.

b) While computing the value of securities, the closing rate for the trade date prior to

the settlement date (T-1 day) should be considered after appropriate hair-cut viz.

VaR margin rate applicable for the security in the Capital Market segment.

c) In case the member applies haircut more than VaR rate on a regular basis and the

actual margin is collected and exposure is provided accordingly, then such higher

rate may be considered for determining the amount to be retained, provided the member has intimated the requirement of additional margins to the clients through

the policy and procedures document and consistently through the daily margin

statements issued to clients.

d) No inter client adjustment/ passing of Journal Entries can be done/ considered for

the purpose of settling client accounts.

e) Obtaining of authorization from the clients to the effect that no settlement need be

done for running accounts is contradictory to the SEBI requirement and hence not

permissible.

Whether the securities pledged to Trading Member need to be unpledged while doing

the settlement?

Excess securities (in the form of margin pledge/re-pledge) with Trading Member (TM),

Clearing Member (CM) or with Clearing Corporation (CC), after adjustment of the 225%

of the margin liability need not be unpledged for the purpose of periodic settlement.

Can Members issue payments through physical mode, while settling the accounts of

the clients?

For the purpose of settlement of funds, the mode of transfer of funds shall be by way

of electronic funds transfer viz., through National Electronic Funds Transfer (NEFT),

Real Time Gross Settlement (RTGS), etc.

Members may issue a physical payment instrument (cheque or demand draft), only in

cases where electronic payment instructions have failed or have been rejected by the

bank and after keeping adequate record of the same.

Further, in case offailureof electronic paymentinstructions due to incorrect bank account

details, members shall obtain correct bank details from clients and update their records

after keeping adequate audit trail.

Is there any threshold amount below which members may not be required to settle

client’s account?

No. Retention of any amount towards administrative / operational difficulties in settling

the accounts of clients is not permitted.

When should a member send statement of accounts for funds / securities?

As clarified vide Exchange circular NSE/INSP/47227 dated February 03, 2021, every

member shall send a complete ‘Statement of Accounts’ for funds, securities and

commoditiesin respect of each of its clients on weekly basis. Members have to send the

‘Statement of Accounts’ on or before the next four trading days of subsequent week.

Further all members will continue to send ‘statement of accounts’ containing an extract

from the client ledger for funds, an extract from the register of securities/commodities

displaying all receipts and deliveries of securities/commodities and a statement

explaining the retention of funds/commodities within 5 days from the date of

settlement.

Notwithstanding anything contained above, Member shall issue the statement of

accounts for funds, securities and commodities for such period as may be requested by

the client from time to time.

The statement of accounts may be sent in hard or in soft form as per the consent

obtained from the client and POD / dispatch register / logs of email sent should be

retained by themember.

Members may refer Exchange circular NSE/INSP/47227 dated February 03, 2021, for

the format of the statement of accounts for funds and securities/commodities.

Is statement of account required to be issued in case no trades are done by the

clients?

The members shall not be required to send the ‘Statement of Accounts’ to clients with

zero funds, zero securities and zero commodities balances and also has been flagged as

‘Inactive’ (i.e., if no trades are carried out by the client in the last 12 months across all

Exchanges) in the UCC database ofthe Exchange.

In which circumstances the settlement need not be done by a member?

The periodic settlement as per the above- mentioned rules (Point no.1) is not required

to be done in the following cases:

a) Clients settling trades through “custodians.”

b) Margin received in the form of Bank Guarantees and Fixed Deposit Receipts, which

are created by clients.

c) Clearing members who are clearing trades of custodial participants/ trading

members

d) Cheques received by the Member from the clients and credited in the respective

client ledger but uncleared on settlement date.

e) In the case of new client, no settlement would be required on first settlement date

(i.e. first Friday of the Month or Quarter as per the preference of client) immediate

after registration of client. For example, a client who registered on October 01,2022

and opted quarterly settlement, would not be required to be settled on the first

settlement date i.e. October 07,2022 and should be settled on next settlement date

i.e. January 06,2023. However, members shall ensure that, if the client is having

credit balance, and has not done any transaction in the 30 calendar days since the

last transaction, the credit balance shall be returned to the client by TM, within next

three working days.

Can a member retain funds of clients towards obligations towards its sister

companies?

While settling client accounts, a member cannot retain funds in excess of the balances

mentioned in Point 5.

Accordingly, while ascertaining retention amount, a member cannot consider debit

balances of the client which are arising in the books of sister concern / associate of the

member registered in same/other exchanges / commodities broking.

Can the Member get the funds due for settlement invested in any other instrument

after taking consent from the client?

No. All Members are advised to strictly comply with the abovementioned requirement

relating to running account settlement and ensure strict adherence to the timelines

prescribed therein. Further, members should ensure to credit the settlement amount to

the client bank account directly and not run any schemes to invest the actual settlement

amount with the consent/without consent of the client.

Can the Member settle running account of funds of clients which are scheduled to

be settled in the month of September and October (till October 06,2022) directly on

October 07,2022?

Yes, running account of funds of clients, which are scheduled to be settled in the month

of September and October (till October 06, 2022) may directly be settled on October 07,

2022.